Technical analysis requires practice, patience, and commitment to master. Below are some of its key elements that every trader should know. To know more you can visit bmmagazine.co.uk

How to Use Candlestick Charts

Candlestick charts have been around for a long time. They give you the necessary information for a given Bitcoin trade duration. It comprises of a body, a wick, and has color. The color tells you whether the trading price dropped or rose, the wick tells you how high up or down low the prices went, and the body tells you the range of trading prices within the duration.

This provides excellent detail for technical analysis. A small body indicates a narrow price range in trading, and a big candle indicates the trading occurred in a broader price range. This is useful in trading and tells you what kind of trades are happening and what kind of earnings can be expected within a given trade duration.

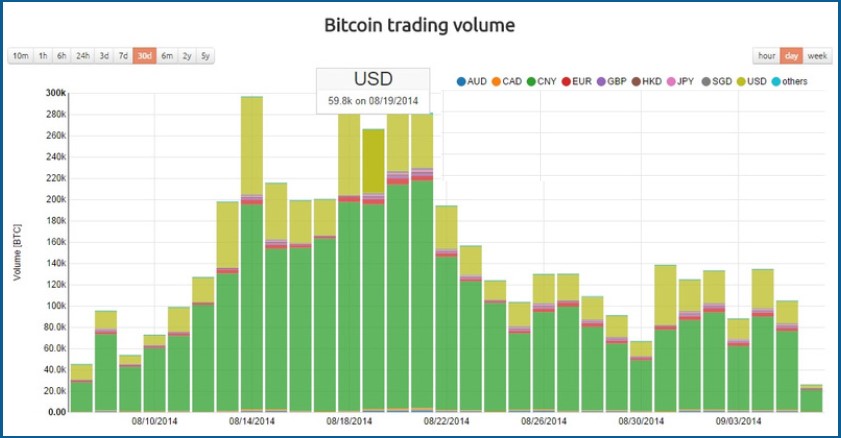

Trading Volume

Reading candlesticks without looking at the trade volume is a big mistake during trading. Each bar tells the amount of bitcoin being traded during a trade period. It is critical to technical analysis. A general rule of thumb is to trade on a high volume market as a low volume is a good indicator of price volatility.

Additionally, it is a good measure of a price trend. If you see red candlesticks for a while, you may be tempted to sell as well, given the decreasing price. But if you factor in low volume, indicating the trend is not very strong, and you should hold on. The same is the case with green candlesticks. If you don’t see many people buying, it could indicate a sudden dip in prices.

Common Patterns

As mentioned before, technical analysis is more than just lines. But what are these lines, and how do they help to recognize patterns? The two most important are support and resistance. Support lines tell you the lower limit of where the prices of bitcoin can drop and bounce back. The resistance line tells you the ceiling at which its price may have difficulty crossing. These levels are judged based on past market performance, giving an idea of when the price is expected to peak, when it’s about to drop, which direction the market is going and how volatile it is. The lines reveal recognizable price patterns over time in triangular shapes, most commonly, ascending and descending triangles. In both cases, the price converges, but at the point of convergence of ascending triangles, the price shoots up, but it drops low for descending triangles, telling a trader the best times to buy and sell.

Final Thoughts

Though technical analysis is a great way to formulate a bitcoin trade strategy, a good trade strategy must include many factors. Other means like fundamental analysis and indicators like MACD, RSI, and Bollinger bands can further strengthen your foresight on bitcoin prices. It is up to you to determine whether you have enough knowledge for a confident trade.